How To Calculate Customer Lifetime Value For Ecommerce

Understanding the value of customers is essential for any eCommerce business seeking long-term growth and profitability.

Knowing how to calculate customer lifetime value in eCommerce can help businesses predict the overall revenue a customer will likely contribute throughout their connection with the company.

Calculating CLV allows eCommerce businesses to make more educated judgments about marketing strategies, customer retention initiatives, and overall business planning.

In this blog, we will review the essential stages and methodologies on how to calculate customer lifetime value for eCommerce, ensuring that you optimize your business potential and build long-term customer connections.

Table of Contents

What is Customer Lifetime Value (CLV)?

Before understanding how to calculate customer lifetime value for eCommerce we will first understand what exactly is Customer Lifetime Value.

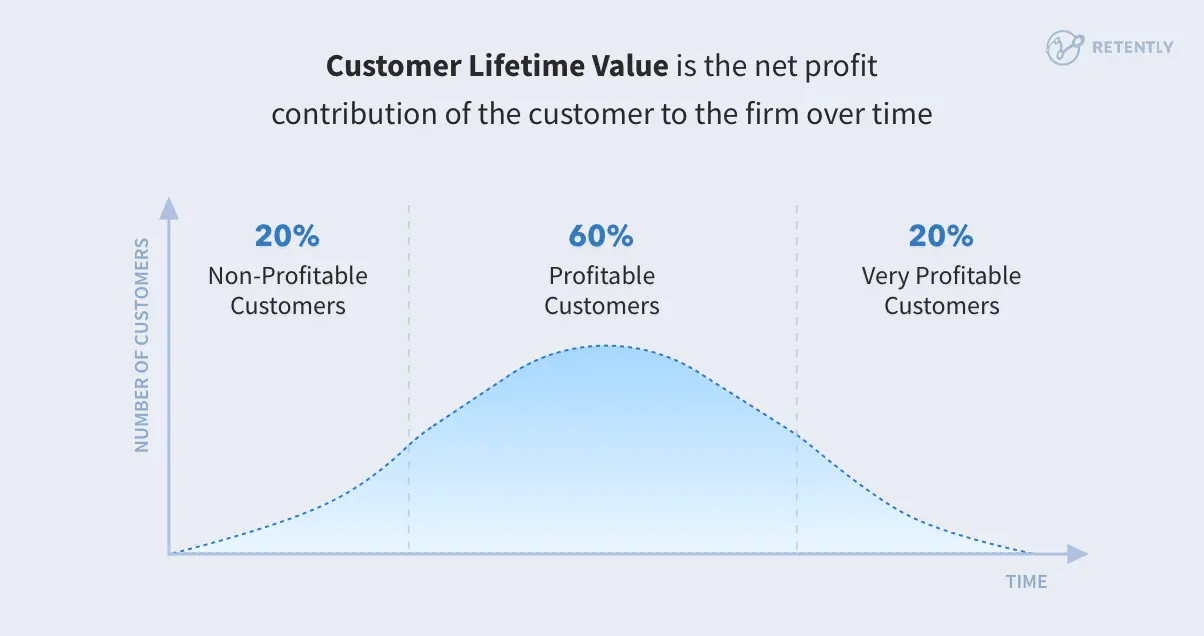

CLV is a business and marketing term that estimates how much income a customer will likely create for a company throughout their relationship.

It helps businesses understand the long-term worth of attracting and retaining customers.

CLV considers characteristics such as the customer’s average purchase value, frequency of transactions, and length of association with the business.

Customer Lifetime Value Formula

While learning how to calculate customer lifetime value for eCommerce, below is the formula that can help you with the process

Customer lifetime value is calculated as

Customer Lifetime Value = Customer Value x Average Customer Lifespan

The CLV result represents the revenue you estimate an average client will create during their time with your company.

Calculating CLV allows organizations to make informed decisions about how much to invest in gaining new customers, how to prioritize customer retention efforts, and how to segment their client base for focused marketing techniques.

Importance of Customer Lifetime Value (CLV)

Understanding how to calculate customer lifetime value in eCommerce is critical for optimizing business strategy and increasing long-term profitability. Here’s why it matters :

- Strategic Insight: CLV shifts the focus from short-term gains to long-term customer relationships, controlling decisions about gaining, keeping customers, and service improvement.

- Marketing Precision: Understanding CLV allows for more effective utilization of marketing resources. It helps discover high-value clients, optimize acquisition costs, and adapt marketing strategies for higher ROI.

- Product Development: CLV insights guide product strategy by highlighting features that improve customer happiness and loyalty, resulting in higher lifetime value.

- Segmentation Strategy: It provides effective client segmentation based on value, enabling more targeted marketing and service strategies that increase overall customer experience and retention.

- Financial Planning: CLV enables precise revenue forecasting and budgeting, which aids strategic investments and operational planning.

- Competitive Advantage: Businesses that master CLV gain a competitive advantage by minimizing churn and cultivating long-term client connections, resulting in higher profitability than competitors.

To summarize, estimating customer lifetime value for eCommerce assesses financial success and leads strategic decisions in marketing, product development, and customer support, promoting long-term growth in a competitive industry.

Key Components of CLV

Client Lifetime Value (CLV) is calculated by many essential components describing the value the customer delivers to a company throughout their relationship. These components include:

- Average Purchase Value: This is the average amount of money a customer spends per transaction when purchasing from your eCommerce site. It is derived by dividing a customer’s total revenue by the number of purchases.

- Average Purchase Frequency Rate: This indicator measures how frequently a consumer purchases over a period, such as a month or a year. It helps in understanding customers’ purchasing habits and repeat purchase trends.

- Customer Lifespan or Duration: This is how long a customer continues to purchase from your eCommerce firm. It is critical to precisely predict how long a typical consumer is active and engaged with your business.

- Client Profit Margin: This is the profit earned from each client after deducting the cost of goods sold (COGS) and other direct costs connected with supplying the customer. It provides a more precise measure of each customer’s net contribution.

- Retention Rate: The retention rate indicates the percentage of customers who continue buying from your company over time. A greater retention rate usually results in a higher CLV since maintaining customers decreases the need for costly purchase attempts.

- Discount Rate or Cost of Capital: This aspect considers the time value of money when calculating the present value of future cash flows. It helps determine the current worth of future revenue earned by a customer.

These components work together to calculate CLV and provide insights into customer behaviour, purchasing habits, and your eCommerce business’ overall profitability.

Understanding and improving these components allows organizations to effectively allocate resources to maximize CLV and create long-term customer connections.

How To Calculate Customer Lifetime Value For Ecommerce

Learning how to calculate customer lifetime value for eCommerce involves evaluating the total revenue that a client is likely to create throughout their engagement with your firm. Here’s a step-by-step instructions:

Step 1: Define the Time frame

The first step of how to calculate customer lifetime value for eCommerce begins by determining a period for analysis, such as one year, five years, or ten years. This will be your CLV time horizon.

Step 2: Collect Relevant Data

Next, collect the following essential metrics:

- Average Purchase Value: Determine the average amount a customer spends per transaction.

- Purchase Frequency: Determine how frequently clients purchase during your specified time window.

- Customer Lifespan: Determine how long a typical customer continues to buy from your company.

Step 3: Calculate the Average Customer Value

Calculate average customer value using the formula

ACV = Average Purchase Value × Purchase Frequency

Step 4: Estimate the Customer Lifespan

Determine the average customer’s length of stay on your eCommerce site. This could be based on past data or industry benchmarks.

Step 5: Calculate Customer Lifetime Value (CLV)

Once you have ACV and the expected customer longevity, compute CLV using this formula:

CLV = ACV × Customer Lifespan

Step 6: Interpret and Use CLV

After computing CLV, the last step to learn how to calculate customer lifetime value for eCommerce is to interpret the number to help make business decisions:

- Segmentation: Identify high-value client categories to focus marketing efforts.

- Retention strategies: Create strategies for retaining high CLV customers over time.

- ROI analysis: Determine the return on investment for attracting and keeping customers.

Example of Calculation

Average Purchase Value = $50.

Purchase frequency = 3 times per year.

Customer Lifespan = 5 years.

Calculate the ACV:

ACV = $50 * 3 = $150

Calculate CLV:

CLV = $150 * 5 = $750

As a result, the Customer Lifetime Value (CLV) in this scenario is $750.

Understanding and implementing these steps for calculating customer lifetime value for eCommerce can help eCommerce organizations make more educated marketing decisions, boost customer retention, and increase overall profitability.

Conclusion

In conclusion, understanding how to calculate customer lifetime value for eCommerce is essential for every online business looking to maximize profitability and sustainability.

eCommerce platforms and businesses can strategically invest in attracting and keeping customers’ efforts by calculating the total revenue expected from clients throughout their relationship with the company.

CLV assists in identifying and prioritizing high-value client segments, directs personalized marketing activities, and improves overall customer happiness and loyalty.

As the eCommerce landscape evolves, using CLV as a strategic metric enables businesses to make more informed decisions, build long-term customer relationships, and achieve long-term success in a competitive digital world.

FAQs

How can CLV data be used to improve customer relationships?

CLV data enables businesses to personalize customer interactions, offer targeted promotions, and anticipate customer needs based on purchasing behaviour, thus promoting more substantial and loyal relationships.

How often should CLV calculations be updated?

CLV calculations should ideally be updated regularly, depending on the business model and industry dynamics. Quarterly updates are standard, but more frequent updates may be necessary in fast-changing markets.

Can CLV be negative?

Yes, CLV can be harmful if the cost of acquiring and servicing a customer exceeds the revenue generated from them over their lifetime. It indicates that the business may need to reconsider its customer acquisition or retention strategies.

Is CLV calculation applicable to different customer segments in Ecommerce?

Yes, CLV calculations can be applied to different customer segments within eCommerce. Segmenting customers based on behaviour, demographics, or purchase history allows businesses to personalize marketing efforts and optimize CLV strategies accordingly.

What tools or software can help automate CLV calculations for Ecommerce businesses?

Several tools and software available automate CLV calculations, such as customer relationship management (CRM) systems, analytics platforms, and specialized CLV calculators. These tools streamline data collection, analysis, and reporting for efficient CLV management.