How To Calculate Customer Lifetime Value For Ecommerce

It’s valuable to note that customer retention for any ecommerce business is fundamental for making profit in the long run.

If you understand how to compute customer lifetime value in eCommerce, it aids in forecasting the revenue expectations from a customer during their engagement with the organization.

Determining CLV enables better decision making regarding marketing expenditures, initiatives related to customer loyalty, and business in general, for eCommerce companies.

This blog post sets out to describe the main steps and approaches on how to estimate customer lifetime value for Ecommerce and, in doing so, achieve business optimization and foster customer loyalty.

What is Customer Lifetime Value (CLV)?

We will define Customer Lifetime Value before learning how to calculate customer lifetime value for eCommerce.

CLV represents the forecasted revenue an organization expects from a customer throughout their entire relationship with the company.

This metric allows business to determine how valuable an investment in a customer will be in the long run.

It takes into account qualitative aspects such as the average value of the customer’s purchases, how often they buy, and how long they have been with the company.

Customer Lifetime Value Formula

While learning how to calculate customer lifetime value for eCommerce, below is the formula that can help you with the process

Customer lifetime value is calculated as

Customer Lifetime Value = Customer Value x Average Customer Lifespan

The CLV result represents the revenue you estimate an average client will create during their time with your company.

Calculating CLV allows organizations to make informed decisions about how much to invest in gaining new customers, how to prioritize customer retention efforts, and how to segment their client base for focused marketing techniques.

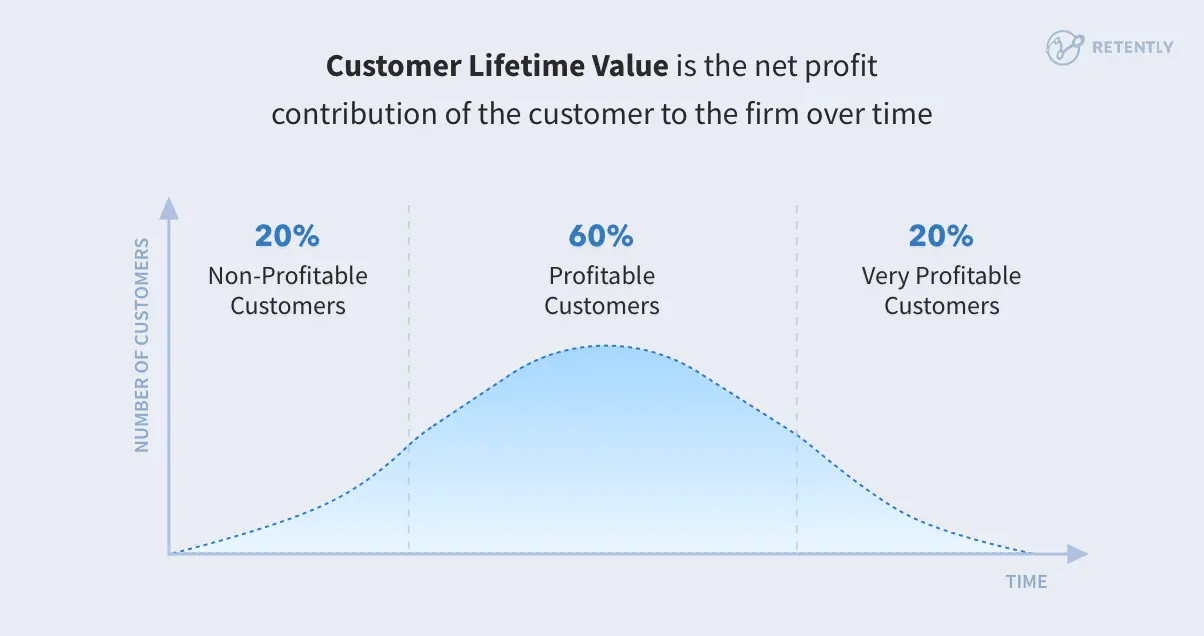

Importance of Customer Lifetime Value (CLV)

Analyzing customer lifetime value in relation to eCommerce helps to optimize a business strategy that can increase profit in the long-run. This is something someone should pay attention to:

- For comprehensive analysis: CLV gives control on gaining and keeping customers and aids in focussing upon long term customer relationships instead of just short term goals.

- For advanced marketing: Knowledge of CLV helps in determining expensive and inexpensive clients, aids in drying ad spend and boosts marketing strategies for greater ROI.

- To innovate products: CLV is a valuable tool that aids in product strategy development by exposing product features that need to increase customer delight and loyalty.

- For smarter marketing practices: It divides clients into different value brackets enabling stm strategies that improve overall customer experience and retention.

- Financial Projections: This means better and more strategic spending, forecasting, and smooth operational planning.

- Competitive Benefit: Businesses that master CLV gain competitive edge, lower defection rates, improve the relationships between clients leading to higher profitability.

In conclusion, evaluating customer lifetime value through eCommerce measures a business’s financial success while guiding strategies concerning marketing, product, and customer support to encourage growth in a hostile environment.

Key Components of CLV

Client Lifetime Value (CLV) is calculated using various factors that quantify the value a customer brings to a company throughout their lifetime. These factors are the following:

- Average Purchase Value: This refers to the average amount spent by a customer in a single transaction on your eCommerce site. It is calculated from the total revenue obtained from a customer divided by the total number of purchases made.

- Average Purchase Frequency Rate: This metric measures how often a consumer buys products during a defined duration, such as a month, several months, or a year. It assists in gaining insight into customers’ purchasing behavior and tendency to repeat purchases.

- Customer Lifespan or Duration: This reflects an amount of time a customer continues buying from your eCommerce business. Being able to accurately predict how long an average customer remains active and engaged with your business is very important.

- Client Profit Margin: This is how much profit each client generates after the costs of the goods sold(COGS) and other direct expenses related to servicing the client have been paid. It allows for a better estimation of each customer’s true net contribution.

- Retention Rate: This retention rate shows how many customers keep buying from your company, in other words, how many customers you are able to retain overtime. Usually a greater retention rate leads to a higher CLV because trying to maintain customers is less expensive than trying to acquire new customers.

- Discount Rate or Cost of Capital: These components include consideration of the time value of money when estimating the current value of future cash inflows. It enables the estimation of the current value of gross revenue from a customer.

The three elements are used together to calculate CLV and gain an understanding of customer behavior, their purchasing habits, and the eCommerce business profitability to the company.

By knowing and adjusting these components, CLV could be increased which would enable organizations to balance resource allocation effectively to achieve desired customer relationships.

How To Calculate Customer Lifetime Value For Ecommerce

Learning how to calculate customer lifetime value for eCommerce involves evaluating the total revenue that a client is likely to create throughout their engagement with your firm. Here’s a step-by-step instructions:

Step 1: Define the Time frame

The first step of how to calculate customer lifetime value for eCommerce begins by determining a period for analysis, such as one year, five years, or ten years. This will be your CLV time horizon.

Step 2: Collect Relevant Data

Next, collect the following essential metrics:

- Average Purchase Value: Determine the average amount a customer spends per transaction.

- Purchase Frequency: Determine how frequently clients purchase during your specified time window.

- Customer Lifespan: Determine how long a typical customer continues to buy from your company.

Step 3: Calculate the Average Customer Value

Calculate average customer value using the formula

ACV = Average Purchase Value × Purchase Frequency

Step 4: Estimate the Customer Lifespan

Determine the average customer’s length of stay on your eCommerce site. This could be based on past data or industry benchmarks.

Step 5: Calculate Customer Lifetime Value (CLV)

Once you have ACV and the expected customer longevity, compute CLV using this formula:

CLV = ACV × Customer Lifespan

Step 6: Interpret and Use CLV

After computing CLV, the last step to learn how to calculate customer lifetime value for eCommerce is to interpret the number to help make business decisions:

- Segmentation: Identify high-value client categories to focus marketing efforts.

- Retention strategies: Create strategies for retaining high CLV customers over time.

- ROI analysis: Determine the return on investment for attracting and keeping customers.

Example of Calculation

Average Purchase Value = $50.

Purchase frequency = 3 times per year.

Customer Lifespan = 5 years.

Calculate the ACV:

ACV = $50 * 3 = $150

Calculate CLV:

CLV = $150 * 5 = $750

As a result, the Customer Lifetime Value (CLV) in this scenario is $750.

Understanding and implementing these steps for calculating customer lifetime value for eCommerce can help eCommerce organizations make more educated marketing decisions, boost customer retention, and increase overall profitability.

Conclusion

In conclusion, understanding how to calculate customer lifetime value for eCommerce is essential for every online business looking to maximize profitability and sustainability.

eCommerce platforms and businesses can strategically invest in attracting and keeping customers’ efforts by calculating the total revenue expected from clients throughout their relationship with the company.

CLV assists in identifying and prioritizing high-value client segments, directs personalized marketing activities, and improves overall customer happiness and loyalty.

As the eCommerce landscape evolves, using CLV as a strategic metric enables businesses to make more informed decisions, build long-term customer relationships, and achieve long-term success in a competitive digital world.

FAQs

How can CLV data be used to improve customer relationships?

CLV data enables businesses to personalize customer interactions, offer targeted promotions, and anticipate customer needs based on purchasing behaviour, thus promoting more substantial and loyal relationships.

How often should CLV calculations be updated?

CLV calculations should ideally be updated regularly, depending on the business model and industry dynamics. Quarterly updates are standard, but more frequent updates may be necessary in fast-changing markets.

Can CLV be negative?

Yes, CLV can be harmful if the cost of acquiring and servicing a customer exceeds the revenue generated from them over their lifetime. It indicates that the business may need to reconsider its customer acquisition or retention strategies.

Is CLV calculation applicable to different customer segments in Ecommerce?

Yes, CLV calculations can be applied to different customer segments within eCommerce. Segmenting customers based on behaviour, demographics, or purchase history allows businesses to personalize marketing efforts and optimize CLV strategies accordingly.

What tools or software can help automate CLV calculations for Ecommerce businesses?

Several tools and software available automate CLV calculations, such as customer relationship management (CRM) systems, analytics platforms, and specialized CLV calculators. These tools streamline data collection, analysis, and reporting for efficient CLV management.

Kartika Musle

A Tech enthusiast and skilled wordsmith. Explore the digital world with insightful content and unlock the latest in tech through my vision.

Leave a Reply