Comparing WooCommerce Wallet with Other Payment Gateways

How customers pay is a big deal when it comes to online shopping. There are many ways to accept payments, but one option that caught my attention was WooCommerce Wallet.

In this blog, we’re comparing WooCommerce Wallet with other payment gateways. We’ll check out what they can do, what makes them suitable, and what might not be great.

We aim to help you understand all your choices so you can pick what’s best for your business.

Please stick with us as we break it down and see what sets WooCommerce Wallet apart from other payment methods.

Table of Contents

What are Payment Gateways?

Payment gateways serve as virtual cashiers in the online world, handling the authorization and processing of transactions made over the Internet.

When you purchase online, these gateways securely encrypt your payment details, transmit them for approval to banks or financial institutions, and then facilitate the transfer of funds to the seller upon approval.

Now, when comparing WooCommerce wallet with other payment gateways, these gateways play a crucial role in enabling smooth and secure online transactions, ensuring that money moves from the buyer to the seller seamlessly and safely.

How Does WooCommerce Wallet Work?

Understanding how exactly the WooCommerce Wallet works is essential before comparing it with other payment gateways.

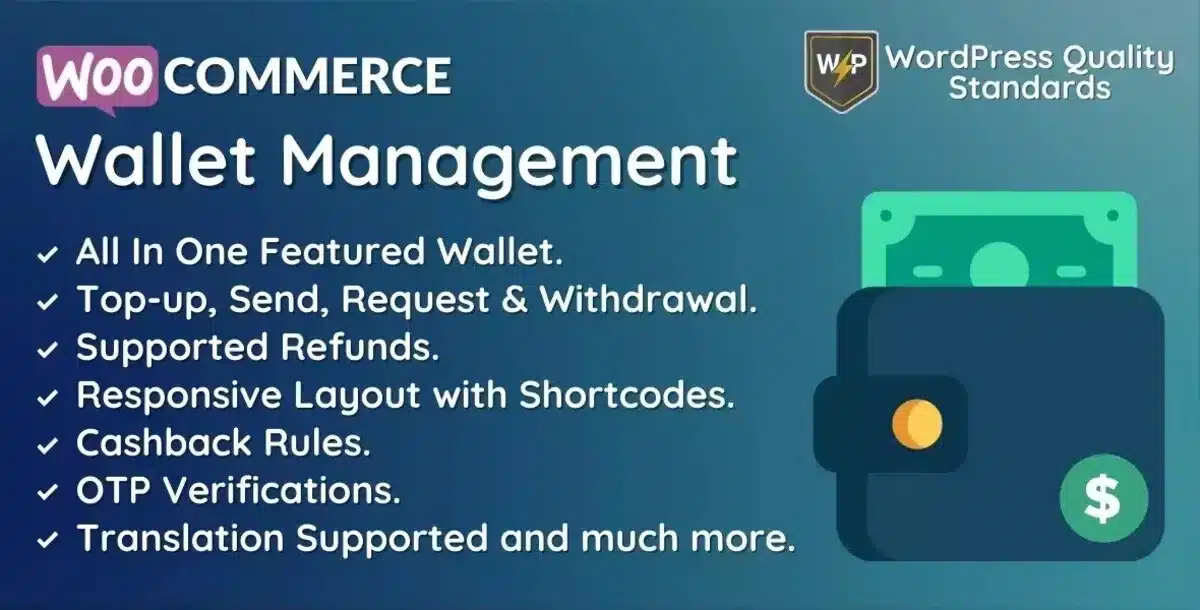

WooCommerce Wallet is a plugin designed for WooCommerce, a popular eCommerce platform built on WordPress.

Here’s how it typically works:

- Installation and Setup: You install and activate the WooCommerce Wallet plugin on your WordPress website, just like any other WordPress plugin. After activation, you configure the settings according to your preferences.

- Customer Registration and Wallet Creation: Customers register on your website and create an account. Once registered, they can access their account dashboard, where they’ll see an option to create a wallet. They can fund this wallet using various payment methods supported by WooCommerce, such as credit/debit cards, PayPal, or bank transfers.

- Wallet Management: Customers can view their wallet balance from their account dashboard. They can add funds to their wallet anytime, and the deposited amount will be reflected in their wallet balance.

- Payment Process: During checkout, customers can pay using the funds available in their wallet. Instead of selecting a traditional payment method like a credit card or PayPal, they can use their wallet balance to complete the purchase.

- Refunds and Withdrawals: If a customer requests a refund for a product they purchased using their wallet balance, you can process the refund directly back to their wallet. Additionally, customers may have the option to withdraw funds from their wallets using their original payment method, subject to your store’s refund and withdrawal policies.

- Reporting and Management: As the store owner, you can access reporting tools and management features related to the wallet system. You can view transaction history, manage customer balances, set wallet-related fees or incentives, and more.

Overall, the WooCommerce Wallet plugin provides added convenience for customers by allowing them to store funds digitally within their accounts, simplifying the checkout process and potentially increasing customer loyalty and retention for your online store.

Other Payment Gateways

Other than WooCommerce Wallet, various payment gateways are available for WooCommerce, providing flexibility and options for store owners and customers. Here are some common ones:

- PayPal: PayPal is one of the most widely used payment gateways worldwide. Customers can pay using their PayPal balance, credit/debit cards, or linked bank accounts. WooCommerce has built-in support for PayPal integration.

- Stripe: Stripe is another payment gateway that supports online payments. It allows customers to pay using credit/debit cards, digital wallets like Apple Pay and Google Pay, and other payment methods. Stripe integration is available through WooCommerce extensions.

- Square: Square offers a comprehensive payment processing solution, including hardware for in-person payments and an online payment gateway for eCommerce websites. With Square integration for WooCommerce, customers can pay securely using credit/debit cards.

- Authorize.Net: Authorize.Net is a payment gateway that enables online payments via credit/debit cards and electronic checks. It provides secure payment processing and fraud prevention features. WooCommerce offers an extension for Authorize.Net integration.

- Amazon Pay: Amazon Pay allows customers to use their Amazon account information to complete purchases on your WooCommerce store. It simplifies the checkout process by using customers’ existing Amazon credentials.

- 2Checkout: 2Checkout, now known as Verifone, is a global payment platform that supports various payment methods, including credit/debit cards and PayPal. It provides features like recurring billing and fraud detection. WooCommerce offers an extension for 2Checkout integration.

- WorldPay: WorldPay is a payment gateway that supports online payments through credit/debit cards, digital wallets, and alternative payment methods. It offers multi-currency support and strong security features. Integration with WooCommerce is possible via extensions.

- Braintree: Braintree, a subsidiary of PayPal, offers payment processing solutions for online and mobile businesses. It supports various payment methods, including credit/debit cards, PayPal, Apple Pay, Google Pay, and Venmo. WooCommerce provides an extension for Braintree integration.

These are just a few examples of the many payment gateways that are compatible with WooCommerce and can be used to compare the WooCommerce wallet with other payment gateways.

The choice of payment gateway depends on factors such as your target audience, geographic location, preferred payment methods, security requirements, and transaction fees.

Comparing WooCommerce Wallet with Other Payment Gateways

When weighing the options for payment gateways on your WooCommerce platform, thoroughly comparing WooCommerce Wallet with other payment gateways is essential.

Here’s an in-depth look at how WooCommerce Wallet stacks up against other payment gateways across various vital factors:

1. Convenience

- WooCommerce Wallet: Offers unparalleled convenience for returning customers, allowing them to store funds and simplify future purchases.

- Other Payment Gateways: Provide convenience through direct payment processing, omitting the need for customers to maintain a separate wallet balance.

2. User Experience

- WooCommerce Wallet: Elevates user experience by simplifying the checkout process for customers with pre-funded wallets.

- Other Payment Gateways: Deliver a seamless checkout experience without the additional step of managing a wallet account.

3. Security

- WooCommerce Wallet: Ensures security by utilizing WooCommerce’s built-in security features, including encryption and safe transactions.

- Other Payment Gateways: Implement strict security protocols to safeguard customers’ payment data during transactions.

4. Integration and Compatibility

- WooCommerce Wallet: Seamlessly integrates with WooCommerce-powered websites; however, further setup and tweaking may be required.

- Other Payment Gateways: Offer integration options for various eCommerce platforms beyond WooCommerce, catering to a broader merchant base.

5. Cost and Fees

- WooCommerce Wallet: This may involve transaction fees or plugin costs depending on the specific implementation and chosen extensions.

- Other Payment Gateways: Typically includes transaction fees or subscription costs, with rates varying based on transaction volume and payment method.

6. Global Reach

- WooCommerce Wallet: Provides flexibility for international transactions, though limitations may exist concerning currency support and accepted payment methods.

- Other Payment Gateways: Often support multi-currency transactions and offer localized payment methods to accommodate a global customer base.

7. Customer Trust and Familiarity

- WooCommerce Wallet: Builds trust gradually as customers become accustomed to the wallet system and its benefits.

- Other Payment Gateways: Benefit from established customer trust and recognition due to widespread adoption and familiarity.

8. Refund and Dispute Resolution

- WooCommerce Wallet: Facilitates a simplified refund process for wallet funds purchases, ensuring transparency and efficiency.

- Other Payment Gateways: Handle refunds and dispute resolution according to their specific policies, which may differ in processing times and requirements.

In conclusion, comparing WooCommerce Wallet with other payment gateways involves evaluating convenience, user experience, security, integration, cost, global reach, customer trust, and refund procedures.

Future Trends of WooCommerce Wallet

When comparing WooCommerce Wallet with other payment gateways, it is essential to know that WooCommerce wallets are gaining popularity as a convenient payment method within WooCommerce-based eCommerce platforms.

Here are some potential future trends for WooCommerce wallets:

- Integration with Cryptocurrencies: With the increasing adoption of cryptocurrencies, there might be a trend towards integrating WooCommerce wallets with popular cryptocurrencies like Bitcoin, Ethereum, or stablecoins. This would allow customers to purchase their cryptocurrency holdings directly from their WooCommerce wallets.

- Enhanced Security Features: As online security threats continue to evolve, there will likely be a focus on improving security features within WooCommerce wallets. This could include implementing advanced encryption techniques, two-factor authentication, and biometric authentication for secure transactions.

- Personalization and Loyalty Programs: Future WooCommerce wallet plugins might offer personalization and loyalty program features. Merchants could reward customers for using their wallets for purchases, offering discounts, cashback, or exclusive deals accessible only through the wallet.

- Seamless Mobile Experience: With the increasing use of mobile devices for online shopping, there might be a trend towards optimizing WooCommerce wallets for mobile platforms, such as using a Progressive Web App for WordPress.

Conclusion

In comparing the WooCommerce Wallet with other payment gateways, it becomes evident that each option presents its own set of advantages and considerations.

While traditional payment gateways offer familiarity and widespread acceptance, The WooCommerce Wallet introduces innovative features such as payment flexibility, enhanced security, cost efficiency, and a seamless user experience.

Merchants deciding between the WooCommerce Wallet and traditional payment gateways must carefully weigh transaction volume, customer preferences, integration requirements, and long-term strategic objectives.

By thoroughly evaluating these considerations, businesses can make informed decisions to effectively meet the evolving needs of their customers while driving growth and success in the competitive eCommerce landscape.

FAQs

What are the advantages of using WooCommerce Wallet over other payment gateways?

One significant advantage is convenience. With WooCommerce Wallet, users can bypass the repetitive process of entering payment details for each transaction, leading to faster checkouts. Additionally, it offers better security as sensitive financial information isn’t shared during transactions, reducing the risk of fraud.

Can I use WooCommerce Wallet alongside other payment gateways on my website?

Yes, absolutely! WooCommerce Wallet can seamlessly integrate with other payment gateways like PayPal, Stripe, or Square, providing customers various payment options based on their preferences.

Are there any transaction fees associated with WooCommerce Wallet?

While WooCommerce Wallet doesn’t impose transaction fees, it’s essential to consider any fees charged by payment processors if integrated with other gateways. These fees can vary depending on your chosen payment gateway and location.

Is WooCommerce Wallet suitable for all types of businesses?

WooCommerce Wallet is versatile and can benefit various business models, including eCommerce stores, service-based businesses, and membership sites. However, it is crucial to assess your business needs and customer preferences before implementing it.

How secure is WooCommerce Wallet for storing funds?

WooCommerce Wallet prioritizes security by implementing robust encryption methods to safeguard user data and transactions. Additionally, since sensitive financial information isn’t transmitted during transactions, it reduces the risk of potential breaches.